kelly criterion formula for excel|Kelly Criterion Explained : Cebu Open a new Excel spreadsheet and create the following headers: Betting Bankroll, Kelly Staking Fraction, 1 (outcome . Tingnan ang higit pa The Textile Trunk is the place to discover the highest quality antique and vintage European textiles including Grain Sacks, Hemp and Linen fabric by the yard or roll and French printed fabrics.

PH0 · What Is the Kelly Criterion?

PH1 · Using the Kelly Criterion for Asset Allocation and

PH2 · The Real Kelly – an #excel implementation for mutually exclusive

PH3 · The Real Kelly – an #excel implementation for

PH4 · Kelly's strategy in sports betting: description, calculation formula

PH5 · Kelly's strategy in sports betting: description, calculation formula

PH6 · Kelly Criterion and Optimal Position Sizing

PH7 · Kelly Criterion Explained

PH8 · Kelly Criterion Calculator

PH9 · Kelly Criterion

PH10 · Essential Gambler’s Excel Formulas

Translation of "bayaw" into English . brother-in-law, no are the top translations of "bayaw" into English. Sample translated sentence: Nang matapos ang state of emergency, dumating ang bayaw ko para sunduin ako. ↔ When the state of emergency ended, my brother-in-law came to pick me up.What is a biophysical profile (BPP)? The biophysical profile (BPP) combines a nonstress test (NST), with an ultrasound examination checking for four different parameters. Each of the 4 ultrasound parameters plus the non-stress test gives a score between 0 and 2, and are added up for a total maximum score of 10.

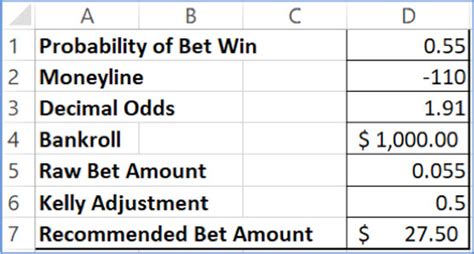

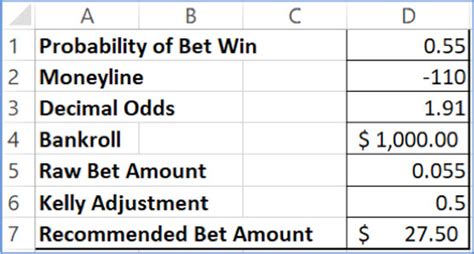

kelly criterion formula for excel*******We’ve developed a Kelly Criterion formula Excel spreadsheet that you can download here. It’s free and easy to use. Simply input your betting bankroll, the odds on offer, your assessed probability for that outcome occurring and your Kelly fraction. Tingnan ang higit paOpen a new Excel spreadsheet and create the following headers: Betting Bankroll, Kelly Staking Fraction, 1 (outcome . Tingnan ang higit paNow we get down to the serious business. In cell I2 add the following formula: =((((E2*G2)-1)/(E2-1))*A2)*B2 In this case. E2 . Tingnan ang higit pa

Enter both your current betting bankroll and your preferred Kelly staking fraction into the cells accordingly. Tingnan ang higit paNext enter the two possible outcomes for this market and the odds on offer for each outcome. In this example we are betting on the . Tingnan ang higit pa Use the Kelly Criterion to identify the mathematical optimum amount of capital which you should alloc. Position Sizing can make or break your trading results. Learn how to use the generalised Kelly Criterion (a.k.a. The Real Kelly) in Excel to find optimal bet sizes for markets with mutually exclusive outcomes. Download the template, .Learn how to use Excel to translate, transform, and analyze sports betting odds and outcomes. Find formulas for break-even win percentage, moneyline, win percentage, and more.

Download our free and easy-to-use Kelly Criterion Calculator by downloading this excel file! All you need to do is choose which column you want to use (depending whether you .

kelly criterion formula for excel The Kelly criterion or Kelly strategy is a formula used to determine position sizing to maximize profits while minimizing losses. The method is based on a mathematical formula designed to enhance expected returns .kelly criterion formula for excel Kelly Criterion Explained The Kelly criterion or Kelly strategy is a formula used to determine position sizing to maximize profits while minimizing losses. The method is based on a mathematical formula designed to enhance expected returns .

By using a precise calculation formula, the Kelly Criterion allows you to make informed betting decisions and maximize your potential profits. So, how does the Kelly . Learn how to use an Excel template to apply the Real Kelly Criterion to multiple bets on different games at the same time. The template supports singles and parlays up to 6 selections and optimizes the bet sizes .

The Kelly criterion is a money-management formula that calculates the optimal amount to ensure the greatest chance of success. The formula is as follows: Where: K % = The Kelly percentage that is the fraction of the portfolio to bet. b .

The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment or bet.

Twitter user @optibrebs recently made me aware of the generalised Kelly Criterion (a.k.a. The Real Kelly) discussed in this @Pinnacle article The Real Kelly To be honest I have been successfully using the simple/naïve Kelly Criterion for years and haven't bothered looking anywhere else. This is how the simplified Kelly looks s = b *.Introduction. This article explores the Kelly Criterion and its application in options trading. Key Takeaways: Kelly Criterion Basics: A mathematical formula for optimal position sizing, balancing risk and reward.; Practical Application: .Fractional Kelly betting The recommended Kelly criterion stake will be multiplied by this value. For standard Kelly betting, set the fractional Kelly betting value to 1.00. If you want to be more conservative than the Kelly criterion, enter a value less than 1 (e.g. input 0.5 if you want to wager 50% of the stake recommended by the Kelly .Kelly Criterion. John Larry Kelly Jr. is the author of the Kelly criterion formula from 1956. It was found that the formula, which has a gambling background and helps to determine the optimal bet size, can also help with finding the ideal investment size. The Kelly bet size is found by maximizing the expected geometric growth rate. In my previous articles we have already seen how the generalised Kelly Criterion can produce completely different results than the simplified Kelly formula that most bettors will use when there are multiple edges in the same game. . This article will explain usage of an excel implementation applying the Real Kelly Criterion to concurrent events.

The Kelly formula in the first scenario — Kelly % = W – [(1 – W)/R] — is not an anomaly.It turns up in many other sources, including NASDAQ, Morningstar, Wiley’s For Dummies series, Old School Value, etc., and is analogous to the one in Fortune’s Formula: Kelly % = edge/odds. But the formula works only for binary bets where the downside scenario is a . Has anyone made the Kelly Criterion Formula for excel? Here is the Formula: f*= (bp-q)/b where * f* is the fraction of the current bankroll to wager; * b is the odds received on the wager; * p is the probability of winning; * q is the probability of losing, which is 1 − p I.Kelly Criterion Explained The Kelly Criterion implies you should bet 22.31% of your bankroll on Real Madrid. Kelly Criterion Horse Racing example The Kelly Criterion also works for horse race betting. Let us say that your horse (Let us call him Lucky Punter) gets 4/1 odds (or 5.0 in decimals, or a 20% implied probability of winning) at the Cheltenham Hurdle.

If everytime we trade we force ourselves to trade 2.5 to 1 come hell or high water one thousand times we should *expect* make on average: $12,000.00 The Kelly criterion is a mathematical formula developed in 1956 by John L. Kelly Jr. while working at AT&T's Bell Laboratories. It helps determine how much to invest in a given asset to maximize . The formula calculates the percentage of your account that you should invest (K%). That is equal to the historical win percentage (W) of your trading system minus the inverse of the strategy win ratio divided by the . 10-Point Article System. Most traders have heard of the “Kelly Criterion”. Developed in 1956 by Bell Labs scientist John Kelly, the formula applied the newly created field of Information Theory to gambling and .

This is the well-known "Kelly Formula" (aka 'Kelly Criterion'), discovered by John Kelly in the 1950’s. . I’ve input the Kelly Formula into Excel, and created a spreadsheet with adjustments .

The Kelly criterion tells us how much of our wealth to put in a promising investment opportunity, yet finance professionals seem to have their heads in the sand, with a level of ignorance bordering on criminal negligence. . even if they excel at finding favourable gambles, only a minority know how to size bets to properly exploit them, and .The Kelly criterion is maximally aggressive — it seeks to increase your capital at the maximum rate possible. Professional gamblers typically take a less aggressive approach, and generally will not bet more than about 2.5% of their bankroll on any wager. . (Note that there is a misprint in the formula for approximating average growth rate . Hello. I'm reading the Dhandho Investor by Pabrai. There's a section in it that uses the Kelly Formula. However, this calculator is no longer available (the website shut down). Can the Kelly Formula be generated in Excel? If not, do you know where I can find one for multiple outcomes (3 or more)? I am looking to use it to determine how much I should bet when I'm .Note: If you would like to read a more mathematical approach to the Kelly formula, please take a look at Ed Thorp's paper on the topic: The Kelly Criterion in Blackjack Sports Betting, And The Stock Market (2007). The Kelly Criterion is a mathematical formula created by John L. Kelly, Jr., which relates to the long-term growth of capital. Kelly developed the formula while working at the AT&T Bell Laboratory. As I mentioned, this formula is a mainstay of the gambling and investing worlds to help manage risk and asset management.

3 talking about this. Round table discussion and events promotion.

kelly criterion formula for excel|Kelly Criterion Explained